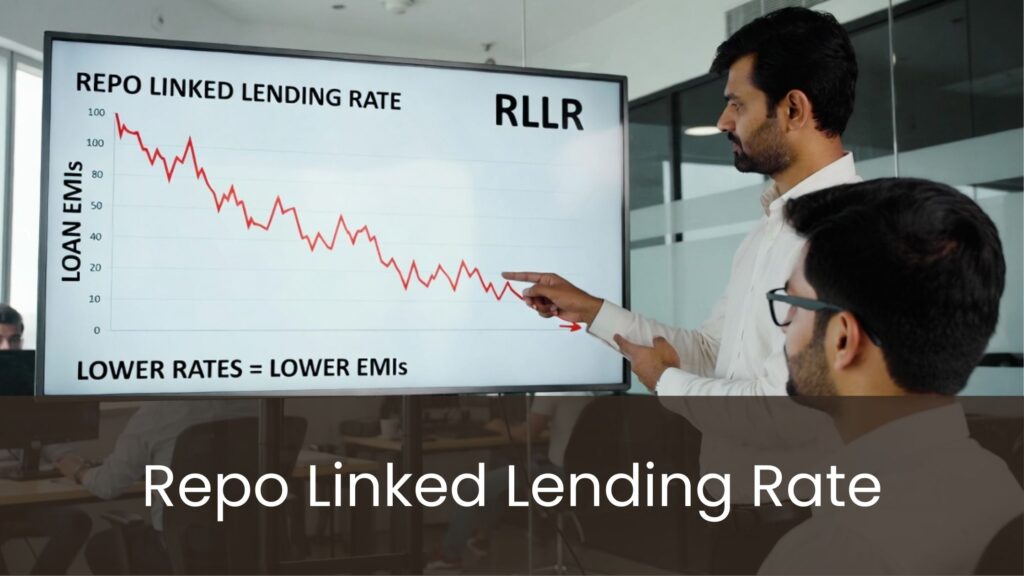

The Repo Linked Lending Rate (RLLR) is a key reform in India’s banking system aimed at making loan interest rates more transparent, fair, and responsive to monetary policy changes. Introduced by the Reserve Bank of India (RBI), RLLR directly links lending rates charged by banks to the RBI’s repo rate. This linkage ensures that the central bank transmits changes in its policy rate faster and more efficiently to borrowers.

Understanding RLLR is important for anyone planning to take a home loan, personal loan, or MSME loan, as it directly affects how much interest they pay over time.

What Is the Repo Rate?

To understand RLLR, it is essential to first understand the repo rate.

The repo rate is the interest rate at which the RBI lends short term funds to commercial banks against government securities. When banks face a shortage of funds, they borrow from the RBI at this rate. The RBI uses the repo rate as one of the primary tools to control inflation and manage liquidity in the economy.

- When the repo rate increases: Borrowing becomes costlier for banks, which usually leads to higher loan interest rates.

- When the repo rate decreases: Banks get funds at a lower cost, enabling them to reduce lending rates.

What Is Repo Linked Lending Rate (RLLR)?

The Repo Linked Lending Rate is a floating interest rate system where banks link their lending rates directly to the RBI’s repo rate plus a fixed margin. This margin includes factors such as operating costs, credit risk, and profit margins.

Formula:

RLLR = Repo Rate + Bank’s Spread (Margin)

For example, if the repo rate is 6.50% and the bank’s spread is 2.00%, the RLLR becomes 8.50%.

The key feature of RLLR is that any change in the repo rate leads to an automatic and faster change in the borrower’s interest rate.

Why Was Repo Linked Lending Rate (RLLR) Introduced?

Before RLLR, banks used systems like the Base Rate and later the Marginal Cost of Funds Based Lending Rate (MCLR). While MCLR was an improvement, it still had limitations:

- Interest rate transmission was slow

- Banks could delay passing on rate cuts

- Borrowers often did not benefit fully from repo rate reductions

To solve these issues, the RBI mandated that new floating-rate personal loans and MSME loans from October 1, 2019, must be linked to an external benchmark, with the repo rate being the most widely adopted benchmark.

How Repo Linked Lending Rate (RLLR) Works in Practice

Once a loan is linked to RLLR, the RBI resets the interest rate whenever it changes the repo rate. This reset typically happens:

- Immediately, or

- At predefined intervals (monthly or quarterly), depending on the loan agreement

The spread charged by the bank remains constant unless there is a significant change in the borrower’s credit risk.

Impact of Repo Linked Lending Rate (RLLR) on Borrowers

1. Faster Transmission of Rate Cuts

Under RLLR, borrowers benefit almost immediately when the RBI cuts the repo rate. This was not always the case under MCLR, where banks could delay passing on the benefit.

2. Greater Transparency

Since the RBI publicly announces and controls the repo rate, borrowers can easily understand why their interest rate changes.

3. Lower Interest Burden During Easing Cycles

During periods of falling interest rates, RLLR-linked loans generally become cheaper, reducing EMIs or loan tenure.

4. Predictable Spread

The bank’s margin remains fixed, preventing arbitrary increases in interest rates by banks.

Impact of Repo Linked Lending Rate (RLLR) on Banks

While RLLR benefits borrowers, it also brings challenges for banks:

- Reduced flexibility: Banks cannot delay rate changes

- Profit margin pressure: During falling repo cycles, margins may shrink

- Better discipline: Forces banks to align lending rates with policy intent

Overall, RLLR improves efficiency but demands better risk management from banks.

RLLR vs MCLR: Key Differences

| Aspect | RLLR | MCLR |

|---|---|---|

| Benchmark | RBI Repo Rate | Bank’s internal cost |

| Transparency | High | Moderate |

| Rate transmission | Faster | Slower |

| Reset frequency | Immediate or frequent | Monthly/annual |

| Borrower benefit | Higher | Limited |

Types of Loans Covered Under Repo Linked Lending Rate (RLLR)

RLLR is mainly applicable to:

- Home loans

- Personal loans

- Loans to micro, small, and medium enterprises (MSMEs)

Fixed-rate loans are generally not linked to RLLR.

Risks and Considerations for Borrowers

While RLLR offers many advantages, borrowers should also be aware of risks:

- Interest rate volatility: If the repo rate increases, EMIs can rise quickly

- Budget uncertainty: Frequent rate changes can affect financial planning

- Long term exposure: Over a long loan tenure, multiple rate hikes may increase total interest outgo

Borrowers must assess their risk tolerance before opting for an RLLR-linked loan.

Should You Choose an RLLR Linked Loan?

An RLLR-linked loan is ideal for borrowers who:

- Expect interest rates to remain stable or decline

- Want transparent and policy linked pricing

- Are comfortable with floating interest rates

However, conservative borrowers who prefer EMI stability may consider fixed rate options, even if they cost more initially.

Frequently Asked Questions (FAQs)

No. RLLR is mandatory mainly for new floating-rate personal loans and MSME loans. Fixed rate loans are not covered.

RLLR changes whenever the RBI revises the repo rate, either immediately or at predefined reset intervals mentioned in the loan agreement.

Banks cannot arbitrarily increase the spread. It can only be changed if there is a significant change in the borrower’s credit profile, as per RBI guidelines.

In most cases, yes. RLLR ensures faster and more transparent transmission of repo rate changes compared to MCLR.

If the repo rate increases, the interest rate on RLLR-linked loans also rises, leading to higher EMIs or extended loan tenure.